Insurance coverage Packages: All the things You have to know

In regards to safeguarding your lifetime, health, and house, insurance offers can supply the assurance you will need. But with lots of options available, how Are you aware which package is good for you? Picking out the proper insurance plan package deal can come to feel mind-boggling, nonetheless it doesn't have to be. In the following paragraphs, we will explore insurance policies deals from numerous angles, serving to you comprehend the things they are, how they function, and how to choose the greatest a person for your needs.

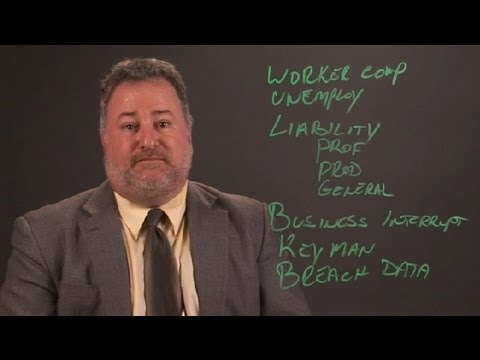

Getting My Insurance For Entrepreneurs To Work

Coverage packages are available a lot of styles and sizes, but at their Main, they supply protection for many challenges in Trade for regular rates. These offers usually Mix numerous varieties of insurance plan into a person, allowing you to guard many elements of your lifetime below a single prepare. Imagine it similar to a one-stop shop for all of your insurance policies requirements. Rather then obtaining independent procedures for vehicle, property, overall health, and existence coverage, it is possible to bundle them collectively in a single effortless package.

Coverage packages are available a lot of styles and sizes, but at their Main, they supply protection for many challenges in Trade for regular rates. These offers usually Mix numerous varieties of insurance plan into a person, allowing you to guard many elements of your lifetime below a single prepare. Imagine it similar to a one-stop shop for all of your insurance policies requirements. Rather then obtaining independent procedures for vehicle, property, overall health, and existence coverage, it is possible to bundle them collectively in a single effortless package.The principal advantage of insurance packages is usefulness. Instead of managing multiple procedures and suppliers, it is possible to simplify the process by choosing one particular package that handles several areas. This not just will save you time but can also save you money. Insurance policy companies normally provide bargains for bundling policies, producing an insurance policies package a price-successful preference. But is it usually the proper choice for everybody?

Another excuse to take into account insurance coverage offers is the pliability they supply. Several insurance coverage vendors enable you to personalize your package deal by choosing the forms of protection you would like. For instance, you may want to Blend motor vehicle insurance, house insurance policy, and existence insurance policy, but with the option to regulate protection stages to fit your demands. This volume of personalization means you're not paying for protection you don't will need.

Not surprisingly, it is vital to grasp the specific parts of an insurance policy package deal prior to making a choice. Most deals incorporate a combination of life insurance policy, overall health insurance plan, car insurance policy, house insurance policy, and often even journey coverage. Each type of coverage serves another objective and is particularly intended to protect you from distinct pitfalls. For instance, everyday living insurance plan assures Your loved ones is looked after financially if some thing happens for you, though car coverage safeguards you in the event of an accident.

Lifestyle coverage is a crucial component of many insurance plan offers, as it offers economic security in your family and friends during the event of the Loss of life. It might help address funeral bills, pay off debts, and provide ongoing help for your family's residing expenditures. Well being insurance plan, Alternatively, covers healthcare expenditures, ensuring you can afford necessary treatments and remedies without breaking the financial institution. Acquiring both of those different types of insurance coverage in one deal makes sure comprehensive protection for both you and your loved ones.

Automobile insurance plan is yet another critical element of many coverage offers. It offers defense from the occasion of a mishap, masking fix fees, medical expenses, and liability for damages brought on to Many others. Some insurance policies deals even supply more benefits, like roadside aid, rental car or truck coverage, and glass repair. It can be important to make certain that your automobile insurance policies coverage is adequate, particularly if you depend on your vehicle for every day transportation.

Excitement About Insurance Coverage Advice

Home insurance plan is commonly included in insurance plan packages, featuring security on your residence and possessions. It can help go over the cost of repairs or replacements if your own home is damaged by fireplace, flood, or theft. As well as covering the framework of your home, household insurance offers may provide coverage for personal belongings, legal responsibility for injuries that occur on the assets, and non permanent living expenses if your home results in being uninhabitable.One of several most significant benefits of insurance coverage deals would be the possible for financial savings. If you bundle many procedures alongside one another, insurance policies organizations usually present discounts, which can lead to substantial savings. These discounts will vary, Nevertheless they are frequently adequate to generate bundling your procedures a monetarily seem selection. On the other hand, it’s vital to Examine various insurance policy vendors to ensure you're getting the finest deal.

Insurance coverage deals usually are not a person-size-fits-all options. What performs for a single individual may well not work for an additional, based on person circumstances and Tastes. It really is vital to evaluate your special needs just before committing to the offer. Such as, in case you are younger and healthful, you may not need as much daily life or health insurance policy coverage as anyone by using a family members or pre-present wellness ailments. In this kind of situations, a more tailored offer may very well be a better fit.

But what occurs if you want protection for something which's not included in a standard insurance policies package? The excellent news is that many insurance policy companies let you increase added coverage alternatives to your deal. As an example, you should include things like flood insurance policy, pet insurance policy, or identity theft security. Though these additions may possibly increase the Price within your offer, they can provide reassurance by addressing likely dangers you hadn't viewed as.

Being familiar with the good print of the coverage offer is crucial before signing over the dotted line. Though insurance plan businesses try to offer apparent and concise policies, it’s important to read the terms and conditions thoroughly. Pay attention to any exclusions or limitations, such as pre-existing problems for health and fitness insurance policies or high deductibles for house coverage. Getting knowledgeable about what is and isn’t included will reduce disagreeable surprises when it’s time to produce a declare.

Another consideration When selecting an coverage bundle is customer care. The quality of The shopper assist you receive can make a significant variance when managing claims or plan changes. Seek out insurance policies suppliers with a robust standing for customer care plus a reputation of managing claims efficiently. A responsive, practical group may make navigating your insurance package a Significantly smoother experience.